News Article

QIMA 2021 Q3 Barometer

QIMA Q3 2021 Barometer: China's recovery slows down, while ethical compliance hits a 3-year low

China sourcing exceeds pre-pandemic levels, but further growth may be stalled by virus resurgence

Building on a promising Q1, China sourcing has continued to gain ground in Q2, with growth beyond 2019 levels: data collected by QIMA shows demand for China inspections and audits expanding +34% year-on-year in Q2 2021 (which translates to +21% growth compared to Q2 2019). However, with the specter of the pandemic still hanging over the world, this spectacular rebound is headed to a softer landing, as seen from the pace of expansion gradually slowing down throughout the second quarter: from +25% vs. 2019 figures in April to +20% in May and +17% in June.

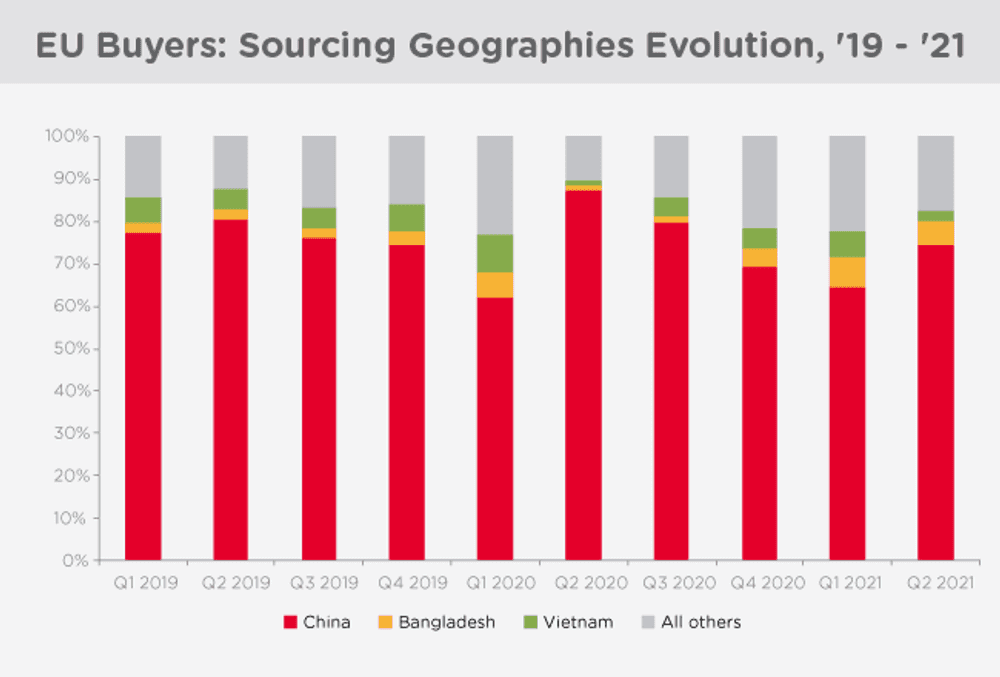

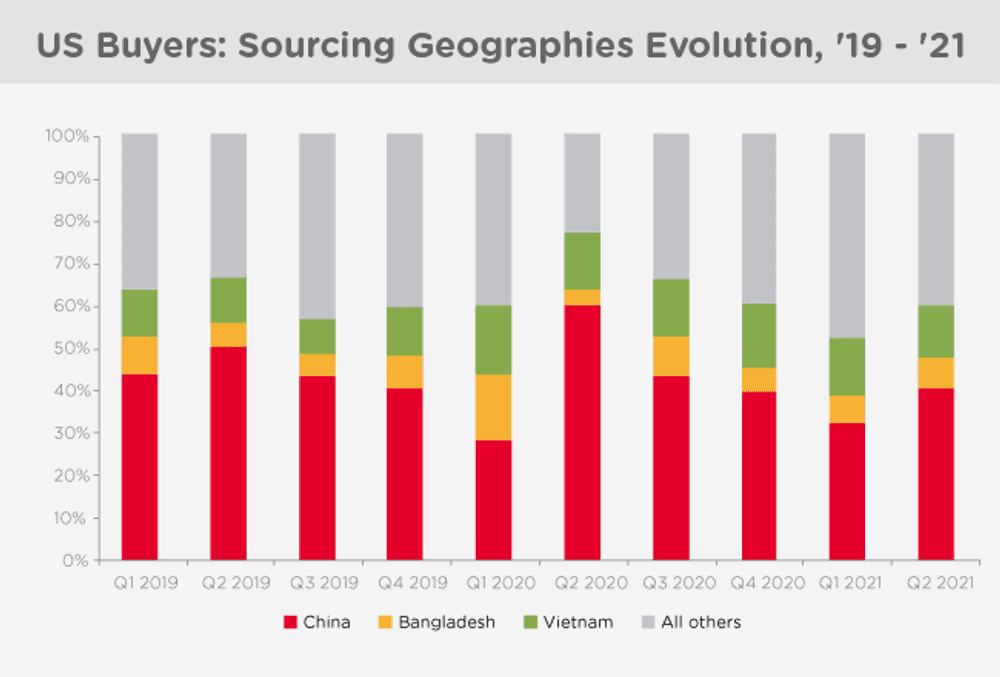

The interest of Western buyers in China sourcing largely follows the same trend, especially for North American buyers: while US demand for China inspections was up +10% in Q2 compared to Q2 2019, the pace of the rebound has been weakening from month to month.

It is also worth noting that China’s sourcing rebound has not affected all consumer goods industries equally: while Homewares and Electronics and Electricals recorded double-digit YoY growth in H1 2021 compared to 2020 and 2019 alike, inspection and audit demand has failed to return to pre-pandemic levels in such sectors as Eyewear and Textiles and Apparel.

Textile and Apparel brands strive to make up for disastrous 2020, with high sourcing demand in South Asia amid diversification efforts

The Textile and Apparel sector has been making headway in recovering from a disastrous 2020, compensating for reduced interest in China with continued expansion through multiple sourcing markets in Asia. South Asia’s textile hubs in particular are enjoying explosive growth, with demand for Textile and Apparel inspections in India and Bangladesh up +81% and +66% respectively in H1 2021 compared to pre-pandemic 2019.

QIMA also recorded growing demand for textile inspections in Southeast Asia (Cambodia, Indonesia, Vietnam), South and Latin America (Mexico, Haiti, Guatemala), and the Mediterranean (Turkey, Morocco, Jordan, Egypt). Notably, the latter region, while traditionally favored by EU buyers, also saw an uptick in inspection and audit demand from US-based brands.

Southeast Asia’s sourcing records four months of consecutive growth, buoyed by Western demand

As sourcing in multiple sectors continues rebounding from the pandemic slump, many sourcing markets of Southeast Asia are benefiting from increased buyer interest, with Vietnam, Cambodia, Indonesia and Thailand all recording double-digit growth in inspection and audit demand. Cambodia in particular remains high on the list of go-to sourcing destinations for US buyers (with Q2 2021 volumes almost doubled compared to Q2 2020, and +23% compared to Q2 2019).

Brands must incorporate human rights concerns into recovery programs, or risk losing earlier progress made towards ethical supply chains

The surge in export volumes can come at the cost of compromised worker safety in manufacturing countries, shows data gathered by QIMA structural engineers during field audits at reopened factories. Among factories inspected for structural, fire and electrical safety so far in 2021, two-thirds were found in need of remediation in the medium or short term. Fire safety was a particularly pressing issue, with over half of factories audited in H1 2021 requiring improvements in the near term.

Meanwhile, ethical compliance continues on the alarming downward trend observed by QIMA last quarter, with average ethical scores deteriorating by a further 4% compared to Q1 2021 to hit a three-year low. These figures show that the continuing fallout of the pandemic, with factories globally struggling to reorganize and adapt to on- and off-supply and demand cycles, threaten to obliterate a lot of the progress towards ethical supply chains made in the pre-2019 period, and emphasize the importance of incorporating human rights and sustainability concerns into brands’ pandemic recovery programs.

QIMA Barometer Key KPIs

Press Contact

Email: press@qima.com