News Article

QIMA 2025 Q3 Barometer: While the US is Mired in Tariff Wars, New Trade Relations Are Being Forged on the Sidelines

Download PDF version or listen to our Supply Chain Soundbites podcast on the go.

The global trade sentiment in Q2 2025 has been largely dominated by the recent fundamental shifts in US trade policy. However, even as tariff shocks rattle global supply chains, long-term sourcing trends remain in effect. As brands, governments and consumers navigate the fallout of the ongoing trade wars, QIMA’s newest barometer report examines how short-term sourcing fluctuations fit into the big picture of global trade.

After Surviving Initial Tariff Turmoil, US Supply Chains Brace for Potential Peak Season Disruptions

While the US administration’s tariff policies took several sharp turns during Q2 2025, the procurement patterns of US-based brands and retailers have stayed largely within the bounds of long-standing trends established before this year’s escalation.

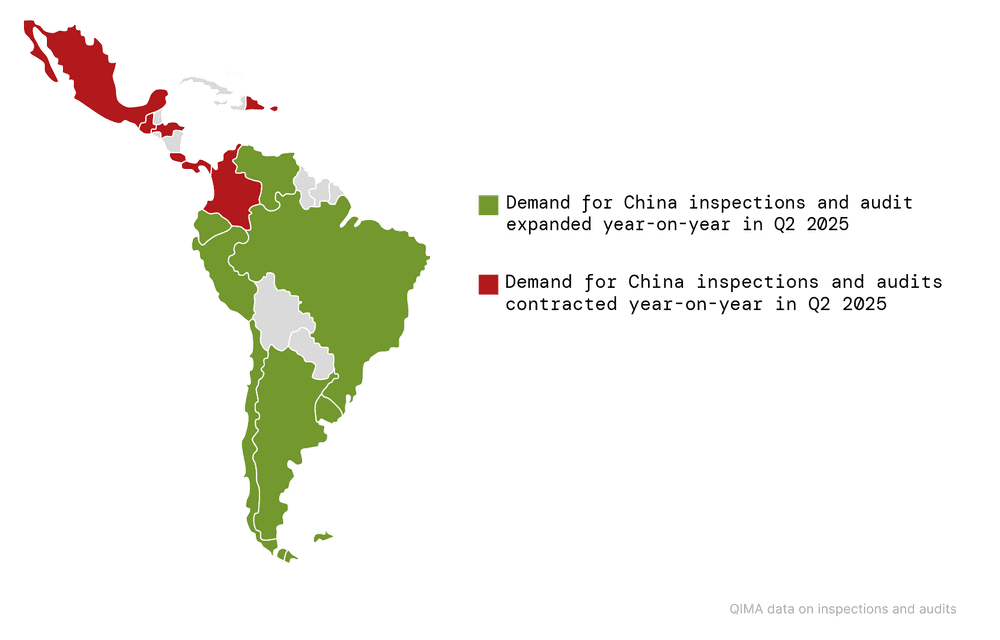

QIMA’s data shows that in Q2 2025, demand from US buyers for inspections and audits in China decreased -24% year-over-year, while rising by +29% in Southeast Asia’s key supplier markets. Yet, this shift is not new: since mid-2023, Southeast Asia’s share of US sourcing has been steadily growing as China gradually lost ground (see Fig. 1). This points to the current uptick in sourcing from Vietnam, Indonesia, and the Philippines as part of an ongoing, multi-year realignment of US supply chains away from China.

That said, the coming months may put US supply chains to a new test. The temporary pause on tariffs for most non-China countries is set to expire in July, coinciding with the kick-off of holiday season procurement and putting US supply chains under renewed pressure just as peak season begins.

Fig. 1: Relative shares of China and Southeast Asia in US sourcing – quarterly trend

Source: QIMA data on inspections and audits

Amid US Tariff Tensions, China Deepens Trade Links with the EU

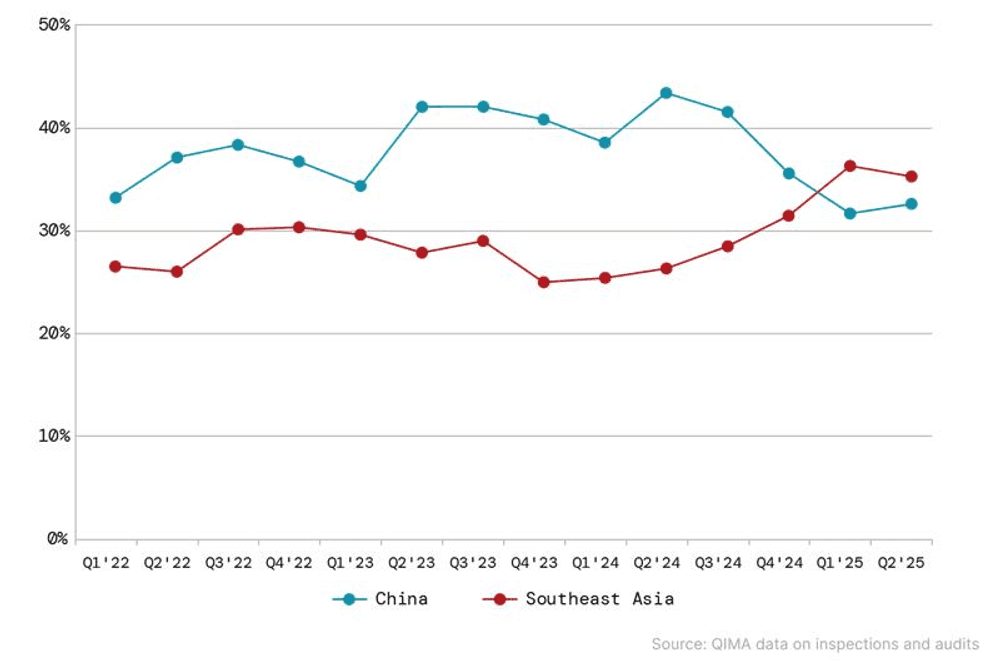

Despite the tentative truce achieved in June, the ongoing US-China trade war is already shaping China’s global supply chain strategies. QIMA’s latest inspection and audit data suggests that China may be reinforcing economic ties with advanced economies outside the US – most notably with the European Union.

In Q2 2025, demand for product inspections in China from European brands and retailers grew +5% YoY, at the same time as China’s share in their sourcing portfolio ticked up. Notably, demand surged in the Netherlands (+27% YoY) and Austria (+21%), alongside moderate growth in Spain (+6% YoY), Poland (+5% YoY) and Germany (+4% YoY).

On a sector level, Toys and Recreational Products emerged as the strongest growth driver. QIMA registered a +24% YoY spike in inspection demand from European buyers for these product categories in Q2 2025 – a clear sign that, despite ongoing diversification efforts, EU sourcing continues to rely on China for certain key consumer products.

Fig. 2: Evolution of China’s share in sourcing of US- and EU-based buyers

Source: QIMA data on inspections and audits

European Buyers Accelerate Southeast Asia Sourcing as Consumer Confidence Recovers

In addition to renewed interest in Chinese manufacturing, European brands and retailers are expanding sourcing efforts both within their home region and overseas, encouraged by stabilizing consumer sentiment.

QIMA data reveals that EU demand for inspections and audits in Southeast Asia rose +13% YoY in Q2 2025, with Cambodia (+9% YoY), Vietnam (+16% YoY) and Thailand (+29% YoY) capturing the largest shares of new business. The textile and apparel sector stood out, with demand climbing +21% year-over-year and outpacing the region’s average.

Nearshoring also remains central to European procurement strategies. Inspection demand across the EU’s nearshoring and reshoring markets grew by 18% YoY in Q2, with Mediterranean sourcing particularly dynamic. Morocco (+53% YoY), Egypt (+73% YoY) and Tunisia (+35% YoY) emerged as top destinations this quarter as brands continued diversifying their supplier portfolios, successfully competing with Turkey, whose flagship textile industry is facing some headwinds this year.

Fig. 3: EU top sourcing regions – by relative share

Source: QIMA data on inspections and audits

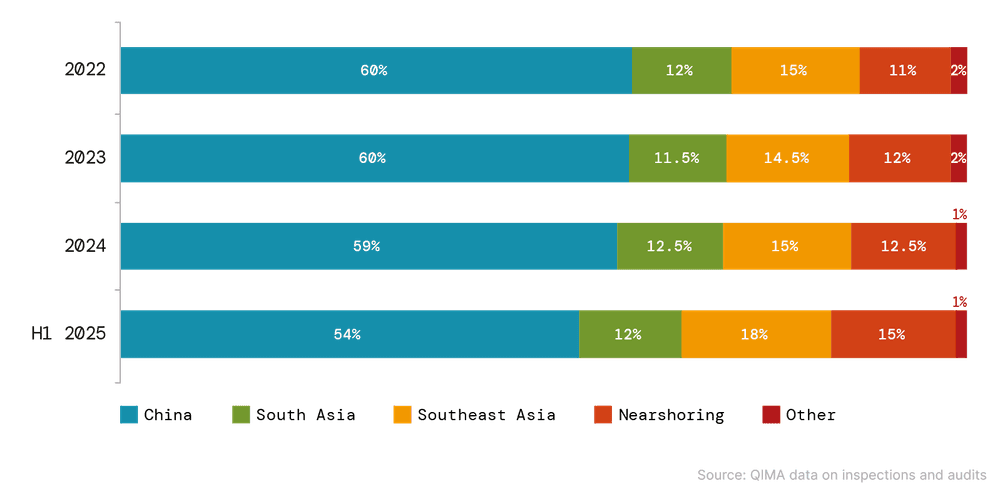

Intra-Regional Trade Underscores Growth Potential in Latin and South America

Following a strong start to the year, sourcing trends in Latin and South America once again demonstrate that the region’s promise extends beyond just US nearshoring.

QIMA data reveals that although US demand for inspections and audits in Latin and South America fell -9% year-over-year in Q2 2025, global demand for the region’s sourcing rose +8% YoY during the same period. A significant driver of this growth is intra-regional trade, with suppliers in Mexico, Colombia, Peru, Chile, El Salvador and the Dominican Republic seeing robust business from local buyers.

These patterns, especially in the context of the region’s deepening ties with China, highlight the rising importance of South-South trade in a global economy weighed down by ongoing uncertainty.

Figure : Demand for China inspections and audits in Latin and South America, Q2 2025

Source: QIMA data on inspections and audits